Merger and Acquisition Advisors - Experts in Lower Middle Market

What’s your vision for the future? Do you know what your options are?

You only get one shot at successfully selling your business, your life’s work.

You need an M&A advisor who has been in your shoes, and has walked the paths before you.

Scroll down for more information

Which Door Should You Enter?

Stay

Majority

Owner

Become a Minority Owner & Continue to Run the Business

Phased Transition of Operational Control

Continuity (sell 70 to 100%)

Non-Ownership Role

Phased Transition of Operational Control

Become a Minority Owner & Continue to Run the Business

Continuity (sell 70 to 100%)

Stay

Majority

Owner

Non-Ownership Role

We are your trusted M&A advisors.

S. Lawrence & Company is a team of relationship-based merger and acquisition advisors and consultants. We start with you, not the numbers.

We work with lower middle market and middle-market business owners and founders from the time they start to consider a sale or make changes to their business, through the transition phase, and after a deal has been completed.

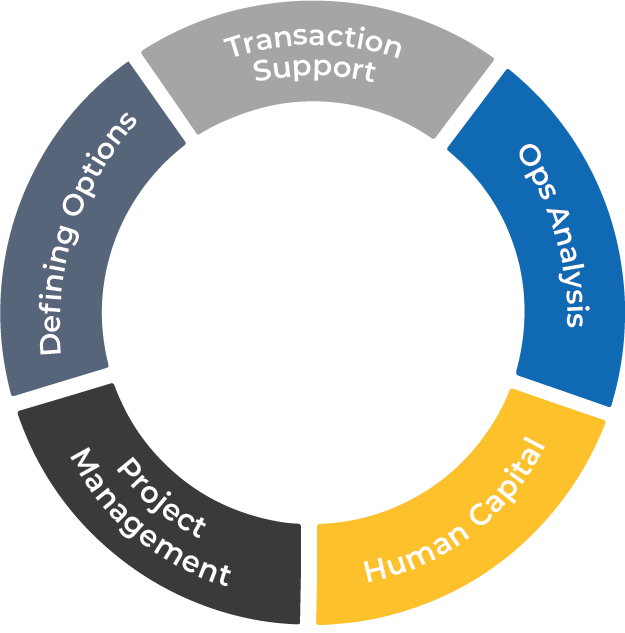

Service

Offerings

- Operations and efficiency assessment

- Supply Chain Analysis

- Technology Assessment

- Operations & IT synergies analysis

- Interview owners and key employees

- Analysis of key employees

- Stakeholder management

- Communication strategy & plan

- Employee retention plans

- Project coordination

- Status reporting

- Risk and problem identification and tracking

M&A/transaction coordination across all parties (buyers, CPAs, lawyers, financing, financial planner)

- Defining goals and objectives of transaction

- Identifying deal structure options

- Presenting transition options

- Market analysis & Industry benchmarking

- Potential buyer identification

- Company valuation analysis

- Financial analysis

- Due diligence support

- Contract negotiation

- Strategy development and execution

- Exit strategy and transition planning

We Take a Relationship-Based Approach To Selling Your Business.

We Take a Relationship-Based Approach To Selling Your Business.

There is more to selling your life’s work than the bottom line. We focus on you, your employees, customers, and community. That focus comes from taking the time to understand your personal and professional goals for the future. We build a customized strategy that best fits your preferred timeline, leadership transition, and goals.

We couldn’t have accomplished our sale without S. Lawrence & Company. Their expertise got us the best price while addressing all of the things that were important to us, all the while keeping 85% of the M&A work off our busy plates.”

Lori

Tesner

Former President & Owner of Acme Building Materials

S. Lawrence & Company built out an acquisition process for us and helped us align our management team for the tasks. Their team’s diverse skill set turbocharged our efforts. And something else – they are just great to work with!”

Gene Pickelman

President of Tri-Star Trust Bank

S. Lawrence’s different approach is excellent. They found me the best buyer that met MY goals and objectives. And they ran the sale for me – while I was able to keep running my business, instead of running negotiations.”

Mike Petersen

Former President & Owner of Petersen Oil